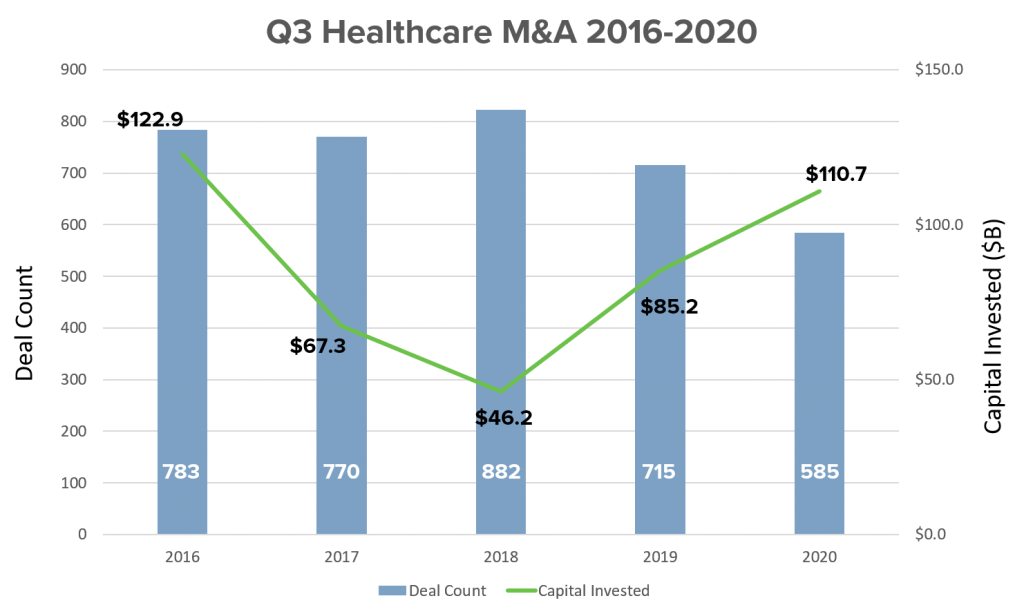

Healthcare Newsletter — Deals, Investments There were 585 deals representing a total reported transaction value of $110.7 billion during the third quarter of 2020, within the market for healthcare and healthcare service businesses that support the life sciences industry. This compares to 715 deals with a reported value of $85.2 billion during Q3 of 2019, an 18% decline in quarter-over-quarter number of deals, but a 30% increase in deal size. This trend — fewer but larger deals — already ongoing seems to have been accelerated by the pandemic in the United States.

The largest publicly reported deal during the quarter was Gilead’s $21 billion purchase of biotech Immunomedics, including its highly valued breast-cancer drug. Also noteworthy was Kohlberg’s investment in PCI Pharma Services, Odyssey’s purchase of ProPharma from Linden Capital and the $18.5 billion strategic investment by Teladoc of Livongo. Other deals included Doximity, Fishawack, Healthline and W20; deal verticals included continuing medical education, data analytics and software services. — Kohlberg Becoming Owner of PCI Pharma Services in $3B+ deal PE firm Kohlberg & Co. reported that it had agreed to acquire a majority stake in pharma supply chain outsourcer PCI Pharma Services. PE Hub reported that the transaction was for more than $3B, based on a $170M EBITDA.

PE Hub, The Wall Street Journal

ProPharma Group, a pharma regulatory and compliance services company is being acquired by PE firm Odyssey from Linden Capital Partners. ProPharma was founded in 2001 and is based in Overland Park, Kansas.

BioSpace | ||||||||||||