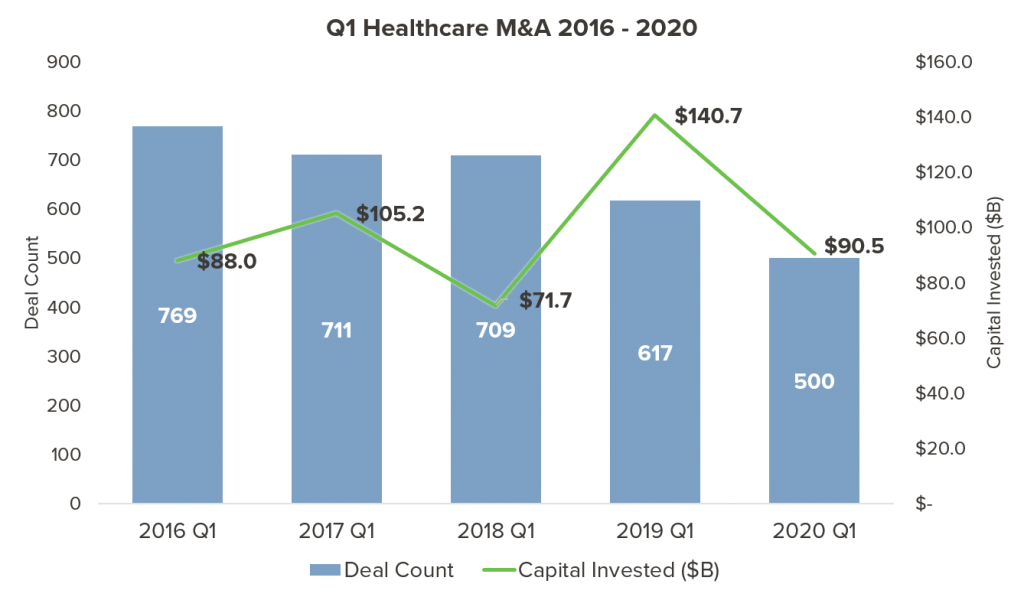

Healthcare Newsletter Deals, Investments There were 500 deals representing a total reported transaction value of $90.5 billion during the first quarter of 2020, within the market for healthcare and healthcare service businesses that support the life sciences industry. This compares to 617 deals with a reported value of $140.7 billion during Q1 of 2019, a decline in 18.9% in number of deals and a 35% decline in overall transaction value.

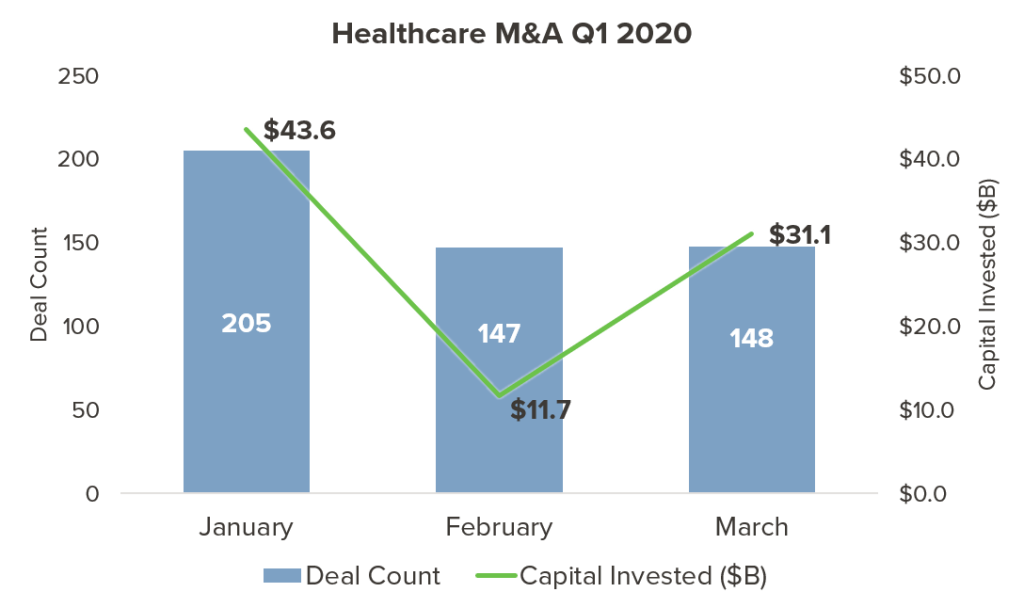

While that quarter-to-quarter decline is noteworthy, indications are that the coronavirus pandemic may have just started to affect this sector during Q1: the total number of deals was about the same from February 2020 – 147 deals – to March – 148 deals. And the total transaction value rose from $11.7 billion in February 2020 to $31.1 billion in March 2020. The largest deal of the quarter was health insurer WellCare’s $17 billion completed merger. Other deals of interest in the sector include Huntsworth’s decision to go private by selling to PE firm Clayton, Dubilier & Rice for $511 million, W20’s announced fourth acquisition of NYC-based agency 21 grams, and WebMD’s purchase of Staywell from Merck.

After WellCare merger, Centene now a ‘$100 billion-plus’ company The size of the deal was previously reported to be $17 billion. The combined entity will serve more than 24 million members, with both Centene and WellCare having a large hold in the government health space.

Modern Healthcare, MedCity News

W2O Group is adding an advertising agency to its portfolio with its acquisition of 21Grams — a New York-based agency focused on healthcare.

The Holmes Report | ||||||||||||