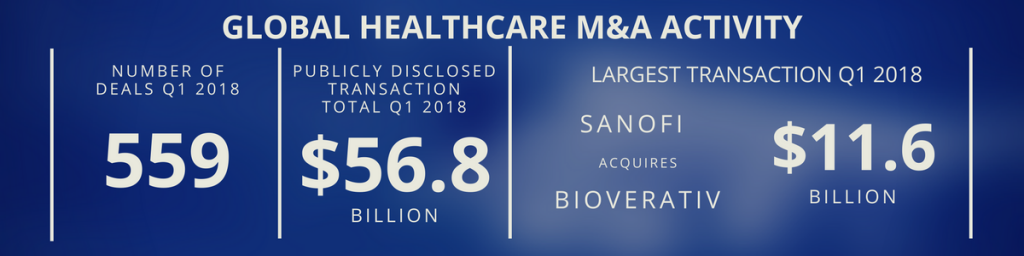

Healthcare Newsletter Deals, Investments As Q1 2018 began, businesses were studying the impact of the overhaul of the US tax system, enacted into law in late Q4 2017. Executives wanted to see how the healthcare sector would be affected. The new tax laws could provide large U.S. drug makers with new-found cash that they may decide to deploy for acquisitions, further investment in drug discovery, and marketing. As the quarter rolled out, deals were announced in many areas of healthcare services either by pharmaceutical, their subsidiaries, digital health, marketing services, and software service companies. Current M&A activity suggests that “big pharma” is willing to pay above average multiples for companies that offer innovative drug discoveries, to ensure they remain competitive in a highly dynamic healthcare market. And those purchases could have a ripple effect throughout the industry. Q1 2018 M&A activity also signals a continuing consolidation and price decline in some aspects of the EHR field but probably a continuing increase in value for speciality EHRs. Other areas of interest suggested by the quarter: continuing interest in improving consumer health through digital like telehealth and patient point of care. Details below.

Pharma deals kicked off Q1 in big way

LA Times | ||||||||||||